Industry 4.0, the fourth industrial revolution in manufacturing, is driving companies to enhance their capabilities by harnessing digital innovation.

Private equity is poised to help. For today’s manufacturing and distribution companies, Industry 4.0 means the use of emerging technologies and applications—think sensors, data analytics, the Internet of Things and artificial intelligence—to connect plants, processes, products and people. Middle market manufacturers looking to step up their Industry 4.0 efforts need a tailored action plan designed to create momentum. Enormous amounts of capital and resources are needed to advance transformation, and private equity presents unique resources and expertise to help manufacturing and distribution companies with capital investments, operational guidance and strategic bolt‑on acquisitions.

Manufacturing On The Up And Up

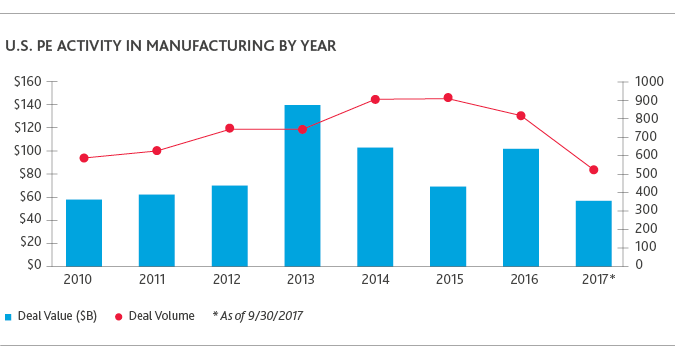

Despite the tempered flow of investments this year, manufacturing is powering ahead. In October, factory orders across the nation reached levels not seen in years, according to the latest regional manufacturing indexes, while the latest PMI Manufacturing Index numbers indicate steady growth. In the broader deal space, the manufacturing and distribution sector still captures 16-18 percent of the entire U.S. deal market, according to

BDO Capital’s Q2 2017 M&A Review.

In the first three quarters of 2017, private equity has driven 526 deals in the manufacturing and distribution space, totaling $57.02 billion in total deal value. This is a dip compared to the 622 private equity-led deals in the first three quarters of 2016, which amounted to $70.22 billion of total deal value.

Why Private Equity & Manufacturing Make Ideal Partners in Industry 4.0

In October, PitchBook senior analyst Garrett Black and BDO Capital’s Managing Director Dan Shea discussed how private equity and manufacturers can make ideal Industry 4.0 partners. Below are highlights from their conversation.

Garrett: Could you tell us where we are in the evolution towards Industry 4.0?

Dan: I think we are really in the early days of Industry 4.0 right now, where companies are gearing up to collect, organize and track their data and then capitalize on what added production and other data can do for their businesses, customers and suppliers. Manufacturers are now adding more sophisticated production equipment and upgrading their information systems so useful data on quality, capacity, maintenance and other areas can be captured and used in automated fashion. It may surprise some to note that many companies big and small don’t even have systems that can talk to each other. Often, the gathering and sharing of data is still manual and ad hoc in nature.

Garrett: For PE buyers and strategic buyers interested in this space, what are some of the challenges they face after acquiring manufacturing and distribution companies?

Dan: I see three, maybe four, major areas of challenge. One is cybersecurity. It’s not a question of if but when you experience a breach. As such, a business’s confidential information is more at risk in the Industry 4.0 era. Required investment is another area of concern. Many are asking, “What are the one-time and annual expenditures needed to implement Industry 4.0, and what is the likely impact from these investments?” This can be hard to ascertain and it’s requiring business execs to consult outside experts to determine the right approach. And lastly, human capital needs may likely change too, with a greater emphasis placed on professionals with tech backgrounds. The silver lining is that manufacturing may actually become more attractive to young professionals as a result. What has historically been a humdrum sector of our economy is becoming much more interesting.

Garrett: How does M&A factor into Industry 4.0?

Dan: Most middle market manufacturing companies were started by and are still owned by individuals, partnerships or families who have a lot of blood, sweat and tears tied up in their businesses. They have advanced these businesses with their own wallet and have made many important and difficult strategic decisions along the way. Now they are faced with potentially dramatic change due to Industry 4.0, and the heightened competition it may create. We are starting to see some business owners say, “It’s time to monetize my life’s work and hand my company off to someone who can make the necessary decisions and investments to ensure success in this new era.” Operations-focused PE buyers can be compelling in this landscape given their portfolio of businesses facing these same issues. They have been fast students on Industry 4.0 and may be best positioned to capitalize on it. In doing so, the seller rollover may truly be a great investment.